Tag: Mortgage

-

The U.S. housing market will continue to be impacted by 3% mortgage rates as homeowners are unwilling to sell and lose their low rates.

The US housing market is being impacted by higher mortgage rates and a lock-in effect, which is constraining both buyers and sellers. The average 30-year fixed mortgage rate reached 7.10% in February 2022, the highest since November 2021, resulting in a drop in demand for properties. Meanwhile, homeowners who locked in lower mortgage rates are…

-

FHA Loans Are Getting Cheaper

It has been announced that the annual mortgage insurance premium will be reduced by 0.30 percentage points, from 0.85% to 0.55% for most new borrowers, which will save homebuyers and homeowners with new FHA-insured mortgages an average of $800 per year. The reduction in the premium is expected to lower housing costs for an estimated…

-

Tips to Help Improve Your Credit Score

Here are some basic tips that can help improve your credit score: Remember, improving your credit score takes time and effort. Stick to these tips and be patient, and you should see improvement over time.

-

Pros and Cons of a Temporary Interest Rate Buydown

A temporary interest rate buydown is a type of financing option where a homebuyer pays an up-front fee to lower the interest rate on their mortgage loan for a limited period of time, typically the first few years of the loan. Here are some of the pros and cons of a temporary interest rate buydown:…

-

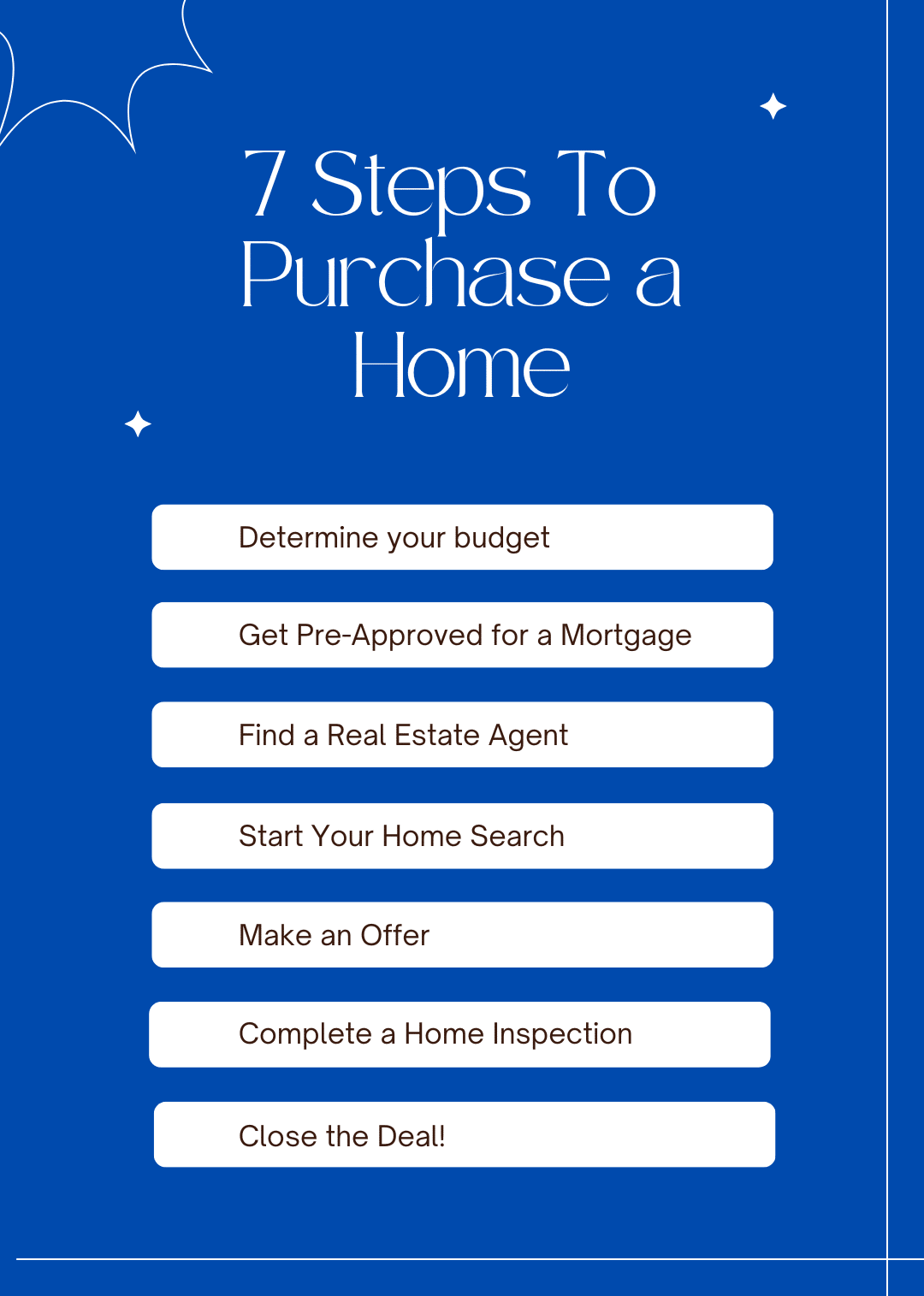

Steps for purchasing a home

Purchasing a home is one of the biggest investments you’ll ever make, and the process can be overwhelming. However, by following these steps, you can make the journey to homeownership a little easier. Purchasing a home is a significant investment, and it’s essential to be well-informed throughout the process. By following these steps, you’ll be…

-

Do’s and Don’ts

Obtaining a mortgage is a very thorough process. The following is a list of some basic things to do, and just as importantly, not to do during and leading up to obtaining a mortgage. DO Make sure you do do the following: DO NOT Make sure you do NOT do the following:.