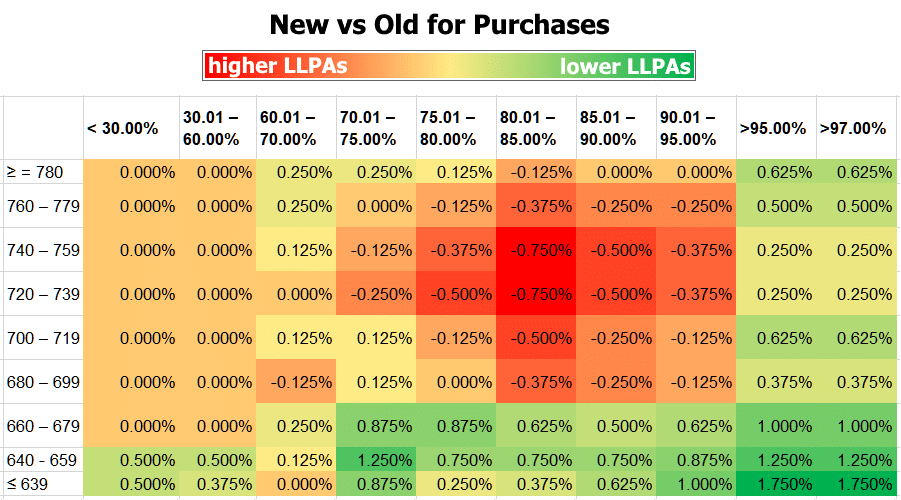

A change to Loan Level Price Adjustments (LLPAs) by Fannie Mae and Freddie Mac in January 2023 has caused confusion among borrowers. While some have claimed that those with lower credit scores will now pay less than those with higher credit scores, this is not the case. LLPAs are based on loan features such as credit score and loan-to-value ratio, and the change actually benefits those with lower credit scores and is at the expense of those with higher credit scores. The difference between what low credit and high credit borrowers pay is smaller than before, but there is no scenario where someone with a lower credit score will pay a lower fee.

LLPAs are almost always implemented based on the date the loan in question is “delivered” to Fannie/Freddie, which usually happens several weeks after the loan is closed. Since the changes went into effect on loans delivered on or after May 1st, 2023, lenders began to implement them weeks ago. Many lenders implemented them months ago, particularly for loans that are locked for longer periods of time.

The change to LLPAs has caused a shift in costs between borrowers with different credit scores. While there is more of an improvement for lower credit score rows on purchases, the change amounts to a tweak of an existing fee structure in favor of those with lower credit scores and at the expense of those with higher credit scores. This means that those with lower credit scores will not pay less than those with higher credit scores, but the difference between the two is smaller than it was before. The change was implemented to promote affordable home ownership, which is part of Fannie and Freddie’s mission.

https://www.mortgagenewsdaily.com/markets/mortgage-rates-04212023