Category: Mortgage

-

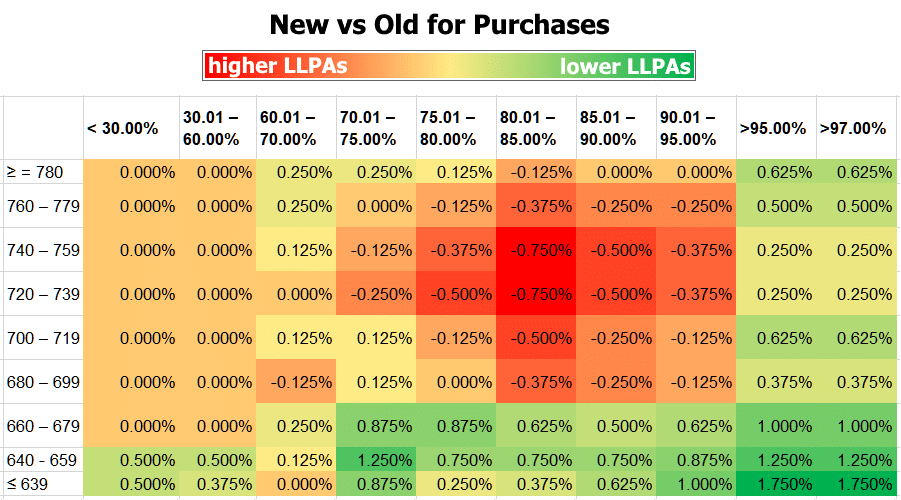

Fact-checking the confusion around changes to mortgage fees based on credit scores

A change to Loan Level Price Adjustments (LLPAs) by Fannie Mae and Freddie Mac in January 2023 has caused confusion among borrowers. While some have claimed that those with lower credit scores will now pay less than those with higher credit scores, this is not the case. LLPAs are based on loan features such as…

-

The U.S. housing market will continue to be impacted by 3% mortgage rates as homeowners are unwilling to sell and lose their low rates.

The US housing market is being impacted by higher mortgage rates and a lock-in effect, which is constraining both buyers and sellers. The average 30-year fixed mortgage rate reached 7.10% in February 2022, the highest since November 2021, resulting in a drop in demand for properties. Meanwhile, homeowners who locked in lower mortgage rates are…

-

FHA Loans Are Getting Cheaper

It has been announced that the annual mortgage insurance premium will be reduced by 0.30 percentage points, from 0.85% to 0.55% for most new borrowers, which will save homebuyers and homeowners with new FHA-insured mortgages an average of $800 per year. The reduction in the premium is expected to lower housing costs for an estimated…

-

Tips to Help Improve Your Credit Score

Here are some basic tips that can help improve your credit score: Remember, improving your credit score takes time and effort. Stick to these tips and be patient, and you should see improvement over time.

-

Pros and Cons of a Temporary Interest Rate Buydown

A temporary interest rate buydown is a type of financing option where a homebuyer pays an up-front fee to lower the interest rate on their mortgage loan for a limited period of time, typically the first few years of the loan. Here are some of the pros and cons of a temporary interest rate buydown:…

-

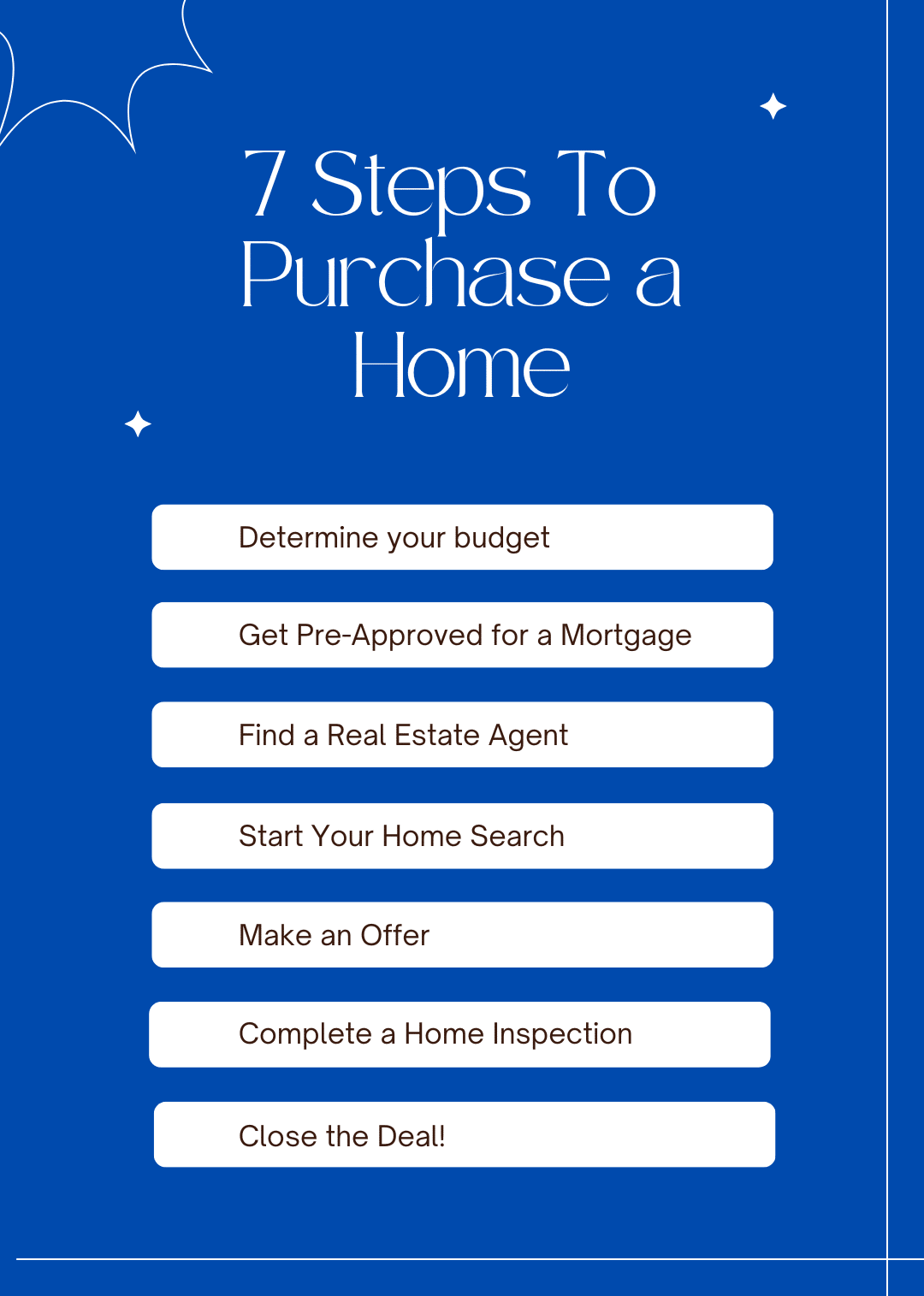

Steps for purchasing a home

Purchasing a home is one of the biggest investments you’ll ever make, and the process can be overwhelming. However, by following these steps, you can make the journey to homeownership a little easier. Purchasing a home is a significant investment, and it’s essential to be well-informed throughout the process. By following these steps, you’ll be…

-

Do’s and Don’ts

Obtaining a mortgage is a very thorough process. The following is a list of some basic things to do, and just as importantly, not to do during and leading up to obtaining a mortgage. DO Make sure you do do the following: DO NOT Make sure you do NOT do the following:.