Category: First Time Home Buyer

-

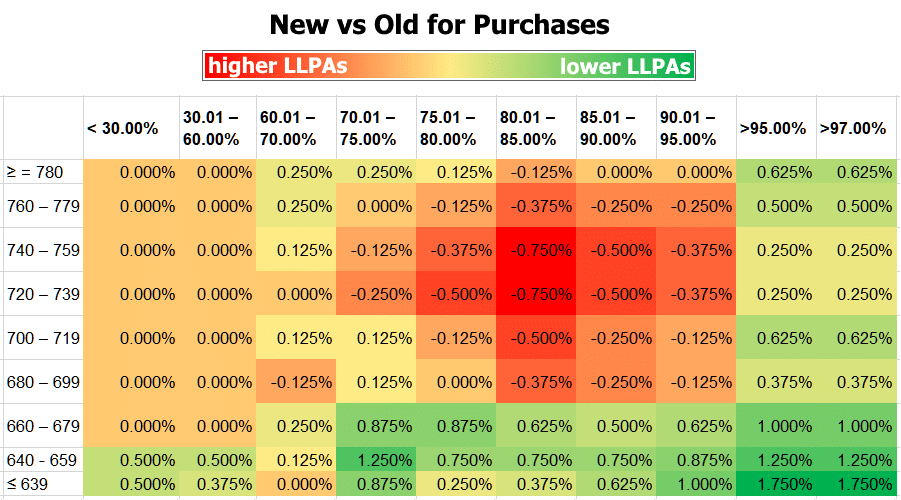

Fact-checking the confusion around changes to mortgage fees based on credit scores

A change to Loan Level Price Adjustments (LLPAs) by Fannie Mae and Freddie Mac in January 2023 has caused confusion among borrowers. While some have claimed that those with lower credit scores will now pay less than those with higher credit scores, this is not the case. LLPAs are based on loan features such as…

-

FHA Loans Are Getting Cheaper

It has been announced that the annual mortgage insurance premium will be reduced by 0.30 percentage points, from 0.85% to 0.55% for most new borrowers, which will save homebuyers and homeowners with new FHA-insured mortgages an average of $800 per year. The reduction in the premium is expected to lower housing costs for an estimated…

-

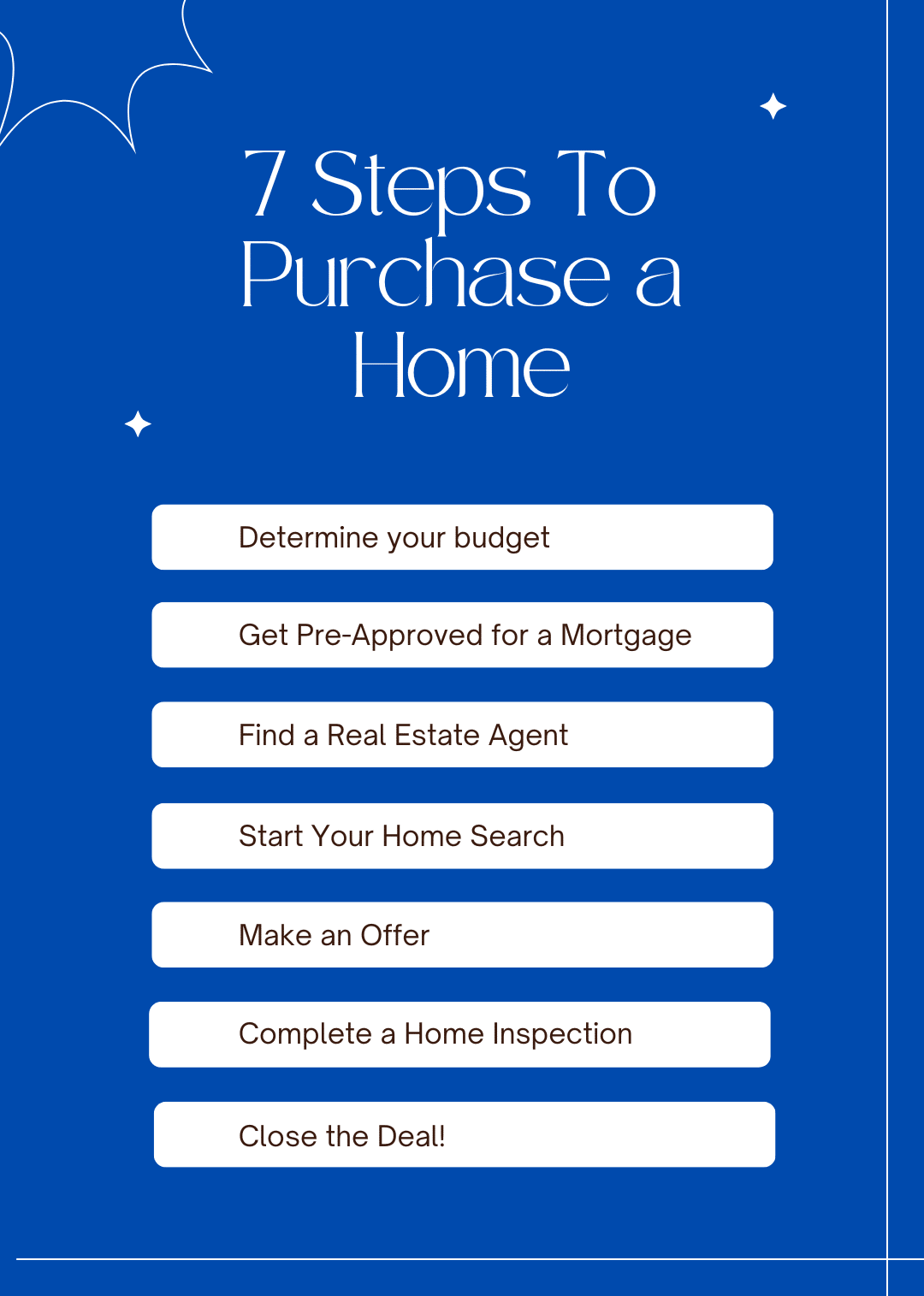

Steps for purchasing a home

Purchasing a home is one of the biggest investments you’ll ever make, and the process can be overwhelming. However, by following these steps, you can make the journey to homeownership a little easier. Purchasing a home is a significant investment, and it’s essential to be well-informed throughout the process. By following these steps, you’ll be…

-

Do’s and Don’ts

Obtaining a mortgage is a very thorough process. The following is a list of some basic things to do, and just as importantly, not to do during and leading up to obtaining a mortgage. DO Make sure you do do the following: DO NOT Make sure you do NOT do the following:.